Local Business Loans - An Alternate To Typical Funding Choices

Content create by-Knapp Mark

Bank loan are an excellent alternative for elevating financing for a company startup. does gen star make business loans -up financings are unprotected car loans supplied by exclusive lenders to a businessperson for taking care of service tasks. Local business startup lendings are used to perform daily service transactions. Small company financing additionally refers to the methods by which a hopeful or already existing local business owner gets cash to begin a new service, purchase an existing company or inject resources right into an already established company to fund future or existing company task.

Capital is the major source of operational funds for a lot of organizations, specifically for start-ups. To elevate funds for cash flow improvement, local business proprietors resort to a selection of options. Among these alternatives is to obtain immediate cash from friends and family. go to this web-site might not be the most effective means as your friends may not have the exact same line of thinking as an institution which supplies bank loan. The majority of the time, individuals require to borrow money versus their house equity to elevate start-up money.

An additional choice for local business owner seeking bank loan is to take out a finance from the Small Business Administration or SBA. The Local Business Management, also called the SBA, is a federal government firm that was set up to aid business owners in America with establishing, running as well as broadening businesses. The SBA guarantees financings to businesses that fulfill pre-defined requirements, such as having less than one year of operation.

Local Business Startup Loans rates of interest vary according to the lender. Financial institutions are taken into consideration prime loan providers because of their long-lasting relationship with the United States economic climate. Prime lending institutions are rated by the government. If you plan to get a financing from a financial institution, it is essential to comprehend how your rates of interest will be identified. do loans for business are deducted can locate this out during a pre-approval meeting where the bank agents gather all the details concerning your organization plan, your credit report and the quantity of money you have in the financial institution.

Given that most banks have an inspecting account, they are good resources of starting funding for services. Small businesses can additionally get other industrial lendings from the bank's online system. Many banks also supply a lowered interest rate for those who get a secured loan. A common option for a safeguarded funding is a house equity finance, which is based on the value of a house.

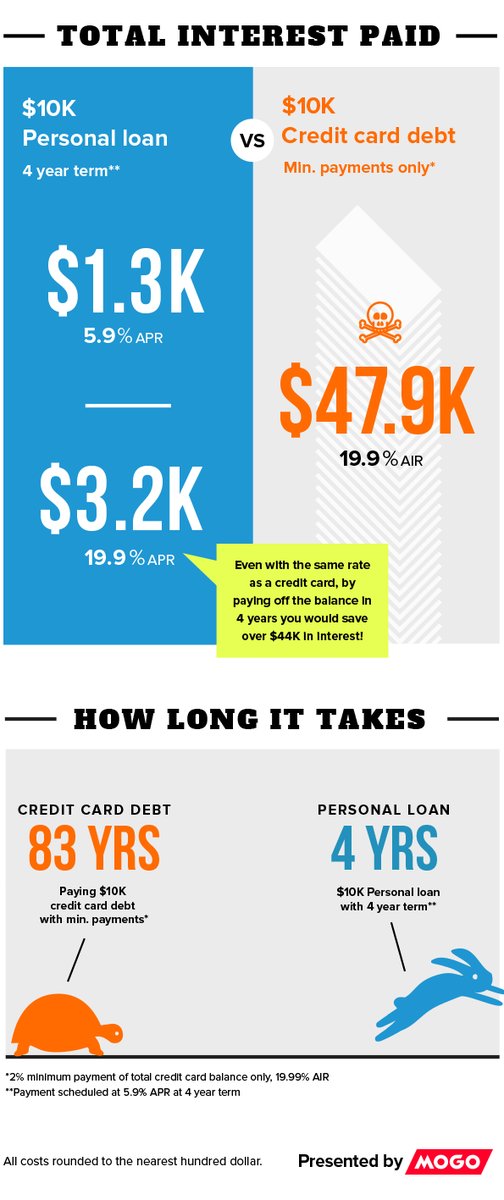

Interest rates are also a consideration when making an application for a small business loan. It is always great to get quotes from different loan providers to compare the cost they would bill for the amount of cash you need to borrow. Some banks will certainly likewise supply unique bargains and low rate of interest for new services. The dimension of the business and its background will also influence the cost you will be asked to pay for a finance. Larger organizations have much better access to resources and have actually been established for a longer amount of time.

To apply for a small business loan via the Small Business Administration, or SBA, you will certainly have to provide individual as well as business information. You will certainly likewise be needed to provide work info and also any type of proof of collateral you have for your funding. You will certainly require to be authorized for financing with the SBA prior to you can utilize it for your business. The SBA has special programs that you can make use of to help you obtain approved quicker.

Bank loan are normally temporary and also can be restored by the lender. This assists business owners who have troubles discovering conventional financing for their company. Bank loan can aid raise the capital of a business swiftly and significantly without the hassle of long-lasting financing plans.